Reddit Charts New Territory with IPO, Offers Shares to Active Users

Reddit, the social media giant, has officially filed for an initial public offering (IPO) on the New York Stock Exchange, eyeing the symbol RDDT. The filing, detailed in an S-1 statement submitted to the Securities and Exchange Commission (SEC), outlines Reddit’s financial landscape and strategic objectives as it prepares to go public.

Financial Snapshot: Impressive Revenue but Unprofitable

According to the S-1 document, Reddit reported a substantial revenue of $804 million in the previous year, primarily fueled by advertising, which accounted for a staggering 98% of its income. However, the company finds itself in the red, disclosing a net loss of $90.8 million for the fiscal year 2023. Despite the financial challenges, Reddit boasts an impressive user base, with 267.5 million weekly active users, over 100,000 active communities, and a monumental 1 billion publications.

User-Centric IPO: Unusual Offer to Active Contributors

Breaking away from the conventional IPO model, Reddit is extending a unique opportunity to a select group of its top users. Moderators and individuals with high karma scores, who have played pivotal roles in shaping Reddit’s vibrant communities, will have the chance to purchase shares in the IPO. This unconventional privilege, typically reserved for seasoned investors, marks a significant departure from traditional practices.

Tiered System for Share Distribution: Rewarding Contributions

Reddit has designed a tiered system for the distribution of shares, prioritizing those who have made substantial contributions to the platform’s community programs. The first tier includes identified users and moderators who have significantly impacted Reddit’s community initiatives. Subsequent tiers invite those with a karma score of at least 2,000 and individuals who have completed a minimum of 5,000 moderator actions to partake in the IPO. The company has earmarked 1.3 million shares of its Class A stock to fund community-related programs, enabling Redditors to bring their innovative ideas to life.

Monetization Strategy: Beyond Advertising

In its S-1 filing, Reddit reveals components of its monetization strategy, which extend beyond traditional advertising. Data licensing and training artificial intelligence (AI) models are highlighted as key elements of this multifaceted approach. Reddit has previously announced a strategic partnership with Google, aiming to generate $60 million annually through AI system training.

Altman’s Influence: OpenAI CEO’s Significant Investment

Adding an intriguing layer to the narrative, Sam Altman, the CEO of OpenAI and a rival company, emerges as a key player in Reddit’s journey to the public market. Altman has invested over $60 million in Reddit stock, securing a substantial 9.2% of Reddit’s voting power. This strategic investment dates back to 2014 when Altman, then president of Y Combinator’s gas pedal, first engaged with Reddit. His continued investments until 2021 underscore his belief in Reddit’s potential.

As Reddit embarks on this unprecedented path, bridging the gap between user engagement and financial markets, the IPO’s outcome will undoubtedly be closely observed, reshaping expectations for social media platforms in the realm of public offerings.

Source: https://www.cnbc.com/2024/02/22/openai-ceo-sam-altman-stands-to-net-millions-as-reddit-goes-public.html

Intel Unveils Ambitious Plans for 1nm Manufacturing Process and $100 Billion Investment in Manufacturing Capacity

Intel made groundbreaking announcements that are set to shape the future of semiconductor manufacturing. The company revealed plans to launch its 1nm manufacturing process in 2027, accompanied by a substantial investment of $100 billion in manufacturing capacity.

Advancements in Node Technology

Intel had previously left the start date for its 14A node ambiguous, but the latest disclosure confirms that production based on the 14A (1.4nm) node is slated for 2026. A significant revelation is the initiation of production/development of the 10A node, set to be Intel’s first 1-nm class node, commencing in late 2027. The “A” suffix in Intel’s node nomenclature signifies angstrom, with 10 angstroms equating to 1 nm.

Performance Improvements and Packaging Capacities

While specifics about the 10A node remain undisclosed, Intel assured that it would deliver double-digit power/performance improvements. The anticipated enhancement over the 14A node is expected to reach 14-15%. Simultaneously, Intel plans to aggressively boost its packaging capacities, focusing on Foveros, EMIB, SIP, and HBI technologies to ensure a steady supply of advanced processors with intricate packaging, including High Bandwidth Memory (HBM).

Global Redundancy and Automation

Intel aims to establish geographically distributed manufacturing facilities, providing global redundancy in its operations. This strategic move will also enable customers to leverage a supply chain entirely based in America. Furthermore, the company is heavily investing in automation, planning to utilize artificial intelligence across various production segments. The integration of AI, from capacity planning and forecasting to improving yields and actual manufacturing operations, marks a significant shift.

Towards Fully AI-Automated Factories

Intel’s vision extends to the incorporation of AI “Cobots,” collaborative robots designed to work alongside humans, and extensive robotic automation within the manufacturing process. The company has not specified a timeframe for these changes, but the comprehensive integration of AI is expected to reshape every aspect of Intel’s operations.

Intel’s transformative approach aligns with the industry’s ongoing efforts to push the boundaries of semiconductor technology. As the race for smaller and more efficient nodes intensifies, Intel’s commitment to 1nm and its massive investment signal a pivotal moment in the evolution of chip manufacturing.

Source: Tom’s Hardware

Mercedes-Benz Shifts Gears: Abandons Ambitious Plan for Exclusive Electric Car Sales by 2030

Mercedes-Benz has announced its departure from the bold vision it embraced just three years ago, indicating a significant deviation from its plan to sell only electric cars after 2030. The company’s decision adds to a growing sense of skepticism within the global auto industry regarding an all-electric future, with industry leaders reevaluating their strategies amid a noticeable slowdown in electric vehicle (EV) sales growth.

Optimism Fades: A Shift in Strategy

Three years ago, Mercedes-Benz was brimming with optimism, boldly proclaiming its commitment to selling only electric vehicles by 2030 and abandoning traditional gasoline-powered cars. However, the recent fourth-quarter earnings report paints a different picture. The company now anticipates that only 50 percent of its sales will be all-electric, marking a substantial retreat from its once optimistic projections. Gas and hybrid vehicles, it seems, will continue to play a significant role in Mercedes’ future for the foreseeable years.

Adapting to Market Dynamics

Mercedes-Benz acknowledges that the pace of transformation will be determined by customer preferences and market conditions. The company aims to cater to diverse customer needs, providing options for both all-electric powertrains and electrified internal combustion engines throughout the 2030s. This strategic shift underscores the influence of external factors on the auto industry’s trajectory.

Caution in Europe: A Reality Check

Even in Europe, where EV sales have outpaced their North American counterparts, Mercedes-Benz CEO Ola Kallenius expressed a pragmatic outlook. He stated that a complete transition to EV-only sales by 2030, both within the European market and for Mercedes specifically, is unlikely. This cautious sentiment echoes a trend among auto industry executives, including Tesla’s Elon Musk, who has warned of a significant slowdown in EV sales growth in 2024.

Industry-wide Caution: A Ripple Effect

The move by Mercedes-Benz follows a series of cautionary statements from industry leaders. Tesla, despite being a pioneer in the electric car space, anticipates a notable deceleration in sales growth. Similarly, companies like Rivian and Lucid have signaled that their production will remain steady this year. Traditional automakers, including GM and Ford, have responded by postponing plant construction and canceling certain models.

Market Realities: EV Sales vs. Hybrid Resurgence

In 2023, EV sales constituted nearly 8 percent of total sales in the U.S. and 13 percent in Europe. While sales are on an upward trajectory, buyers are increasingly discerning, considering factors such as price, charging times, and reliability. Simultaneously, hybrid vehicle sales have witnessed a significant uptick as consumers opt to hedge their bets during the ongoing development of charging infrastructure.

This decision by Mercedes-Benz not only reflects the challenges of achieving an all-electric future but also highlights the need for adaptability in an industry navigating complex market dynamics. The automotive landscape is evolving, and industry players must carefully calibrate their strategies to meet both consumer demands and the practicalities of the market.

Source: The Verge

Nvidia’s Financial Report Shatters Expectations: Profits Soar 265%, Net Income Skyrockets by 769%

Nvidia has emerged as a front-runner in the tech industry’s artificial intelligence (AI) boom, as reflected in their fiscal fourth-quarter results. The company reported profits and sales that exceeded Wall Street forecasts, sending Nvidia shares soaring by approximately 10%.

Record-Breaking Figures Amid AI Craze

The highlight of Nvidia’s financial triumph is a staggering 265% surge in profit and an astronomical 769% increase in net income. The fourth-quarter net income stands at an impressive $12.29 billion, or $4.93 per share, compared to $1.41 billion, or 57 cents per share, from the previous year.

Nvidia’s meteoric rise is intricately tied to the tech industry’s growing fascination with large-scale AI models. The demand for the company’s high-end graphics processors designed for servers has been unprecedented, with models like Hopper and H100 leading the charge.

Data Center Dominance

The data center business has become Nvidia’s primary revenue generator, witnessing an astonishing 409% surge, reaching $18.40 billion. Large cloud providers are driving this surge, relying heavily on Nvidia’s AI chips for server applications. However, recent U.S. restrictions on semiconductor exports for AI to China have cast a shadow on Nvidia’s data center revenues, creating an additional layer of complexity in an otherwise rosy picture.

Gaming Business Holds Steady

Nvidia’s gaming business, which was the cornerstone before the AI boom, reported a growth of 56% year-on-year, reaching $2.87 billion. This segment includes graphics cards for laptops and PCs, some of which find applications in AI. Despite the growth, the gaming business is now overshadowed by the dominating force of the data center.

Mixed Fortunes in Other Ventures

While the AI and gaming sectors bask in glory, Nvidia’s smaller businesses present a mixed bag. The automotive-related business experienced a slight downturn, falling by 4% to $281 million. Conversely, the OEM and other business, housing crypto chips, rose by 7% to $90 million. The graphics hardware division for professional applications also witnessed a commendable 105% rise, reaching $463 million.

Jensen Huang Addresses Future Concerns

Addressing concerns about sustaining this unprecedented growth, Nvidia’s CEO, Jensen Huang, assured analysts during a conference call. The company remains optimistic about future prospects, even as the AI landscape evolves and global regulations impact their business dynamics.

As Nvidia continues to ride the wave of the AI surge, the tech giant seems poised for an exciting and prosperous future, paving the way for innovations that redefine the industry.

Source: CNBC Nvidia’s Earnings Report Q4 2024

SoftBank’s Grand Ambition: Izanagi Seeks $100 Billion for AI Chip Domination

SoftBank Group’s visionary founder, Masayoshi Son, is scaling new heights in his quest for technological dominance. According to a recent Bloomberg report, Son is actively seeking a staggering $100 billion in funding for his latest venture, codenamed Izanagi, poised to challenge Nvidia’s supremacy in the realm of artificial intelligence (AI) chips.

Izanagi is set to collaborate with Arm, a chip design company that SoftBank strategically spun off as a public entity last year, maintaining a significant 90% ownership share. This symbiotic relationship positions Izanagi to leverage Arm’s expertise in chip design for its foray into AI chip production.

In a strategic move reminiscent of SoftBank’s Vision Fund creation, the company aims to secure $70 billion of the targeted $100 billion from institutional investors in the Middle East, with SoftBank itself contributing the remaining $30 billion. The specifics of this ambitious project remain shrouded in secrecy, as SoftBank declined to comment on the Bloomberg report.

Nvidia, a current AI chip market dominator with its GPU chips, faces a potential challenge from SoftBank’s Izanagi. The projected growth in demand for AI processors opens opportunities for innovative alternatives, whether through similar GPU technologies, novel approaches, or entirely different processing methods.

In a parallel development, OpenAI’s CEO Sam Altman is reportedly engaging with investors in the United Arab Emirates to secure between $5 trillion and $7 trillion for a distinct AI chip initiative. OpenAI, at the forefront of generative AI development with models like GPT, emerges as a significant player in the AI chip market due to its substantial chip consumption for various services, including ChatGPT.

While Altman’s project aligns with SoftBank’s broader AI chip ambitions, the Bloomberg report indicates that Izanagi appears to be a separate venture. Details regarding core technology builders and the project timeline remain undisclosed, intensifying the intrigue surrounding these transformative endeavors.

SoftBank’s strategic shift towards AI aligns with its broader transition from substantial returns on early investments in Alibaba. Historically, Alibaba contributed significantly to SoftBank’s profits, but the company is strategically divesting its stake to reinvest in AI. This shift follows a $32 billion loss in SoftBank’s high-profile Vision Fund, prompting a defensive and offensive move into the evolving AI landscape.

Despite challenges, SoftBank, bolstered by its 90% stake in Arm, has experienced a remarkable recovery. The Vision Fund’s recent quarter return reached its highest since March 2021, accompanied by a nearly 50% surge in Arm stock, fueled by the growing demand for AI chips. SoftBank’s CFO, Yoshimitsu Goto, emphasizes Arm’s increasing indispensability in the AI ecosystem.

Arm, acquired by SoftBank in 2016 for $32 billion, went public on the Nasdaq exchange in September 2023, achieving a valuation of $64 billion. With clients such as Apple, Google, Microsoft, and Amazon, Arm’s influence extends beyond AI, encompassing smartphone manufacturing and large language model development.

SoftBank’s revelation of Son’s AI chip project coincided with the company’s first quarterly profit in almost three years, underscoring its resurgence. SoftBank shares surged by 2.8% following the announcement, solidifying Son’s position as a trailblazer in the dynamic landscape of artificial intelligence.

Source: TechCrunch

Jeff Bezos Unloads $2 Billion in Amazon Stock for the Third Time in February

Amazon founder Jeff Bezos has made his third substantial sell-off of Amazon stock this month, raking in a staggering $2.03 billion, according to reports. This comes as Amazon’s total sales for February have already hit an impressive $6 billion.

Unprecedented Liquidation Spree

This recent divestment, totaling about $12 million worth of shares at an average price of $169.50 per share on Tuesday and Wednesday, follows Bezos’ trading plan initiated in November. The plan allows the billionaire to potentially sell up to 50 million shares of Amazon stock, with the latest $2 billion covering approximately 12 million shares, mirroring his previous transaction just a week prior.

Strategic Moves Amid Tax Savings

Bezos’ strategic financial maneuvers are not without purpose. Last year, he announced his intention to bid farewell to Seattle, opting for a move to Miami. This move aligns with his desire to be closer to Blue Origin, his space exploration company, and the family of his fiancée Lauren Sanchez. More crucially, the relocation offers Bezos a substantial tax advantage, potentially saving him hundreds of millions of dollars in taxes on stock sales.

Post-CEO Sales Surge

Notably, this round of stock liquidation is Bezos’ first since stepping down as the CEO of Amazon in May 2021. His departure from the executive role seems to have ushered in a new era of financial maneuvers, showcasing his active involvement in managing his vast wealth.

Wealth Rankings Reshuffled

With this latest sell-off, Bezos currently sits in the third position on Forbes’ list of the world’s richest individuals, boasting a fortune of $191.4 billion. Ahead of him are Bernard Arnault with $223.1 billion and Elon Musk with $205.5 billion, making for a highly competitive field of tech and business magnates.

Future Implications and Market Watch

Analysts are closely watching Bezos’ financial moves, with speculations swirling about the potential implications for Amazon and its market standing. As the e-commerce giant’s founder continues to shuffle his financial portfolio, the market remains on edge, awaiting the next chapter in Jeff Bezos’ strategic wealth management.

Source: CNBC

Google unveils Gemini 1.5 artificial intelligence model

Shortly after the launch of Gemini, Google’s ambitious language model, the tech giant is already taking a leap forward with the introduction of Gemini 1.5. This upgraded version is being positioned as a versatile business tool, a personal assistant, and everything in between. The successor to Gemini 1.0 Pro, Gemini 1.5 Pro, boasts an impressive 87% improvement over its predecessor and rivals the performance of Gemini Ultra.

Utilizing the “Mixture of Experts” (MoE) technique, Gemini 1.5 runs only the necessary portions of its model when processing requests, ensuring faster and more efficient usage. The standout feature is its colossal contextual window, accommodating a staggering 1 million tokens—enabling the model to handle extensive queries and process vast amounts of information simultaneously.

Google CEO Sundar Pichai emphasizes the business applications of Gemini 1.5, citing its ability to add personal context and information at the time of query. Filmmakers can inquire about reviews for an entire movie, while companies can sift through massive financial records concurrently. Pichai hails this as one of Google’s significant breakthroughs.

For now, Gemini 1.5 is exclusive to business users and developers through Vertex AI and AI Studio. The standard version, Gemini Pro 1.5, available to the general public, comes with a contextual window of 128,000 tokens, but users can opt for the million-token version at an additional cost. Google is rigorously testing the model’s security and ethical boundaries, especially regarding the expanded contextual window.

In the race to dominate the AI landscape, Google faces competition from the likes of OpenAI, which recently announced memory for ChatGPT and is set to introduce its own web search. While Gemini appears promising, there’s still considerable work ahead for all players.

Last year’s introduction of the AI-based chatbot Bard is also part of this evolving narrative. Google has decided to rename Bard to Gemini, aligning it with the underlying AI model. Gemini, currently running on the Pro 1.0 model in over 230 countries and territories, now introduces two features: Gemini Advanced and a mobile app.

Gemini Advanced taps into Google Ultra 1.0’s advanced AI model, excelling in complex tasks such as coding, logical thinking, and collaborative projects. Serving as a personal tutor, it tailors instructions and discussions to the user’s learning style, making it invaluable for advanced coding scenarios and content creation.

Available in over 150 countries and initially in English, Gemini Advanced is part of the new Google One AI premium pricing plan. Subscribers will soon enjoy Gemini integration in Gmail, Docs, Presentations, Tables, and more.

Expanding accessibility, Google rolls out mobile experiences for Gemini and Gemini Advanced via new Android and iOS apps. Users can interact through typing, talking, or adding images, providing on-the-go assistance for various tasks. The Gemini app, available for free trial with Google One AI, offers a blend of Google Assistant features, including setting timers, making calls, and controlling smart home devices.

Gemini is set to appear on Android and iOS phones in the US initially, with a global rollout in the coming weeks. The $19.99 per month Google One AI subscription on iOS promises seamless integration with Gemini, marking a significant step forward in Google’s AI ecosystem.

Source: The Verge

U.S. Patent Office bans AI inventions: Human input is critical

The U.S. Patent and Trademark Office (USPTO) has declared that artificial intelligence (AI) systems cannot be named as inventors in patent applications. The agency recently released comprehensive guidelines after soliciting public feedback, outlining the role of AI in the invention process.

Disclosure Mandate for AI-Assisted Inventions

The USPTO clarified that while AI and other “non-human entities” cannot be designated as inventors, individuals utilizing AI tools must disclose this information when registering patents. The guidance emphasizes the need for transparency, requiring applicants to list all material information relevant to the decision-making process.

Significant Human Contribution Requirement

To qualify for patent registration, individuals leveraging AI must have made a substantial contribution to the invention’s development. Mere observation of an AI system’s creative process does not confer inventorship. The USPTO asserts that presenting a problem to an AI system without actively contributing does not merit patent eligibility.

Demonstrating Contribution Through Problem-Solving

The agency outlines that a person’s significant contribution can be evidenced by formulating a problem and building a hint to guide the AI system towards a specific solution. This nuanced approach seeks to recognize the human element in the inventive process.

Intellectual Dominance Alone Doesn’t Suffice

The USPTO explicitly states that merely maintaining “intellectual dominance” over an AI system does not qualify an individual as an inventor. This means that supervising or owning AI technology that autonomously generates inventions does not grant eligibility for patent application.

Historical Precedents and Judicial Backing

This decision follows the 2020 ruling by the USPTO, which restricted patent applications to “natural humans,” rejecting a petition from researcher Steven Thaler who sought to list his AI creation, DABUS, as an inventor. The US courts upheld this decision. Additionally, a separate federal court ruled against copyrighting AI-generated content, solidifying the stance that AI systems themselves cannot hold intellectual property rights.

This landmark decision navigates the evolving landscape of AI integration into inventive processes, balancing the role of technology with the indispensable human touch in patent eligibility.

Apple Vision Pro: Tim Cook’s Visionary Launch and Reviews Unveiled

Tim Cook on headset launch day: “Apple Vision Pro costs $3,500 because it’s the technology of the future, the iPhone introduced us to the mobile computer”

On the day of the launch of the Vision Pro headset, Apple CEO Tim Cook spoke to ABC reporters in New York. He spoke about the vision of the future of such devices.

“Spatial Computing” – A New Frontier

“I think it [Apple Vision Pro] will be used in many different ways because it’s a spatial computer. You know, the iPhone introduced us to the mobile computer. The Mac introduced us to personal computers. This is the first spatial computer,” Cook said.

“The company has several of these. Most companies don’t have them. We’ve had the Mac, the iPod, the iPad, the iPad, the iPhone, the Apple Watch and now the Vision Pro. This is one of those moments.”

Diverse Applications

“People will interact with it in different ways. Some will connect to it with FaceTime. Others will train with it. Surgeons will train on it. The number of use cases is like a computer. It’s just enormous. There are already over 1 million applications for it.”

Augmenting Reality and Tomorrow’s Technology Today

As for whether Vision Pro could lead to people further disconnecting from each other, Cook said its ability to “augment your reality” is there to counteract that. Regarding Vision Pro’s $3500 price point, Cook emphasized that it is “tomorrow’s technology today.”

“This is the technology of tomorrow today, that’s how I think about it. We have 5,000 patents on the product. So we’ve really relied on that. And I’m hoping that somebody will pay for it on a monthly basis who will just buy it. I’ve talked to a lot of people online, they’re just going to buy it. But over time, there’s no telling what’s going to happen. But we think we priced it right today.”

Apple Vision Pro Reviews: A Glimpse into Spatial Computing

The first Apple Vision Pro mixed reality headset, the Apple Vision Pro, is set to launch in the US market this coming Friday. Some foreign publications were able to get their hands on the novelty ahead of schedule and have already prepared reviews of this device. Let’s focus on the main conclusions that reviewers made after testing Apple Vision Pro at home.

Spatial Computing Unleashed

Vision Pro, according to Apple, is the beginning of so-called “spatial computing”, which essentially boils down to running applications around the user.

With the new headset integrated into Apple’s ecosystem, a user can perform tasks ranging from watching movies or TV shows on a huge 4K HDR virtual display to displaying a work environment from a Mac screen, including Excel, Webex, and Slack.

Compromises for Innovation

The headset brings together a number of technologies, solutions, and devices that the user has to wear on their face. Because of this, the company had to make a number of compromises. For example, to reduce the load on the head, the headset receives power from an external source. Even so, the device is quite heavy and can cause discomfort during prolonged use.

Practical Praises and Drawbacks

Apple Vision Pro is characterized by thoughtful design, quality materials, and good manufacturing. The MicroOLED displays are praised for their high resolution, high brightness, and good color reproduction. When wearing the headset, the user is completely isolated from the outside world but continues to see it through the external cameras thanks to the video pass-through feature. However, this solution has some drawbacks such as motion blur, noise, limited color range, and a narrow field of view, especially in low-light conditions.

Revolutionary Control System

The eye- and hand-tracking-based control system received separate praise. It is “light-years ahead of any other consumer hand or eye tracking system.”

“You look at the things you want to control, you press your fingers to control them, and that’s how you navigate the entire interface. You don’t reach out and touch objects: rather your eyes are the mouse and your fingers are the button. You squeeze them together to click what you’re looking at.”

Mixed Reviews but a Positive Outlook

This system isn’t always convenient, though. Sometimes it makes it difficult to use the headset, as “having to look at what you want to control is actually quite distracting.”

Initial reviews of the Apple Vision Pro – a great headset with a few compromises. Overall, The Verge reviewer praised the Vision Pro for its excellent display, good hand and eye tracking, and seamless experience with Apple’s ecosystem. At the same time, the novelty has a number of drawbacks, one of which is the high price of $3499. The image in end-to-end video mode can be blurry, and hand and eye tracking ─ inconsistent and frustrating. Another reviewer notes that the characters are supernatural and somewhat intimidating, and the headset is “pretty lonely.”

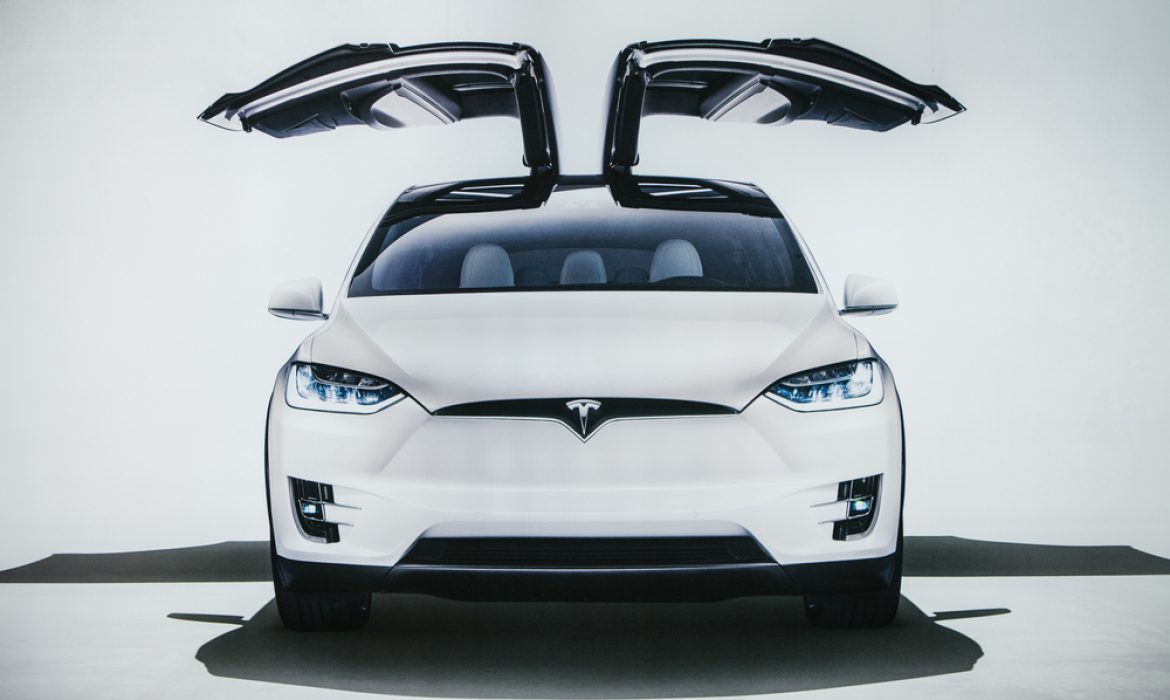

Don’t use Apple Vision Pro while driving ─ U.S. Secretary of Transportation

Since the Vision Pro went on sale last week, the expensive augmented reality headset has been seen in a variety of unusual places, from the gym to airplanes. However, after one owner was spotted with the headset on his head while driving a Tesla Cybertruck on the highway, U.S. Transportation Secretary Pete Buttigich issued a warning, reminding people to use common sense.

In a post on X (Twitter) along with an excerpt from the original video, Buttigich reiterated that “ALL advanced driver assistance systems available today require the human driver to be in control at all times and fully engaged in the driving process.” Similarly, Apple’s headset comes with multiple warnings advising users not to use it while “operating a moving vehicle” or in “any other situation requiring attention to safety.”

After Minister Buttigich’s publication, the creator of the original video, Dante Lentini, told the media that the footage was a “parody” made with friends and the headset was only worn for 30-40 seconds while driving. Additionally, Lentini claims that the footage of him getting arrested was staged in the prank.

It’s important to note that the Cybertruck comes standard with Tesla’s Autopilot system. But that feature has yet to be activated for the first wave of Founder’s Edition vehicles. That means Lentini was driving down the highway with a headset on his head without the aid of any advanced driver assistance systems.

Tesla’s incredible profits from competitors’ internal combustion engine cars

Tesla, renowned for its exclusive focus on Battery Electric Vehicles (BEVs), has amassed a whopping $9 billion in revenue since 2009 by aiding competitors in selling internal combustion engine (ICE) cars. The company’s unique venture into the realm of regulatory credits has proven to be an unexpected goldmine.

Regulatory Credits: A Lucrative Side Business

Tesla’s annual report on Form 10-K, submitted to the U.S. Securities and Exchange Commission (SEC), reveals the unconventional revenue stream. These regulatory credits, essentially subsidies, are purchased by automakers unable to meet zero-emission standards. Notably, Tesla, producing only electric cars, effortlessly fulfills these requirements, capitalizing on this profitable side business.

A Billion-Dollar Profit Stream

In 2023 alone, Tesla amassed $1.79 billion from regulatory credits, contributing significantly to its $96.77 billion total revenue. Since 2009, this unconventional business has injected nearly $9 billion into Tesla’s coffers. While the percentage of these credits in total sales may seem modest, the absence of additional costs ensures that every dollar earned is pure profit.

Unexpected Continuity in Profits

Contrary to expectations, Tesla’s profits from these credits have not waned. Initially considered a temporary boost, the trend persists. In 2020, the company became profitable for the first time, thanks to $1.58 billion in earnings from regulatory credits. Despite predictions of a gradual decline, Tesla continued to thrive, earning over $1.7 billion annually in 2022 and 2023.

Bright Prospects Amidst Stricter Emission Standards

With emission rules tightening globally, Tesla’s regulatory credit business looks set to flourish further. Europe is implementing stricter emission standards, while the UK plans a gradual ban on internal combustion engine cars starting in 2024, mandating a minimum 22% share of zero-emission models in each automaker’s sales structure.

Capitalizing on Competitors’ Electrification Slowdown

The slowdown in electrification efforts by major automakers like Volkswagen and General Motors plays to Tesla’s advantage. Competitors, failing to meet their electric vehicle (EV) goals, significantly cut investments in the electric car sector. Tesla steps in to assist, ensuring its regulatory credit business remains a vital lifeline for those struggling to meet emissions standards.

Prominent Beneficiaries: Volkswagen, General Motors, Honda, and Jaguar Land Rover

Notable beneficiaries of Tesla’s unique business model include Volkswagen, General Motors, Honda, and Jaguar Land Rover. As these companies face challenges meeting emission standards, they turn to Tesla for regulatory credits, solidifying the electric car pioneer’s unexpected role as an enabler in the combustion engine car market.

Tesla’s foray into regulatory credits may be unconventional, but it proves that innovation extends beyond electric vehicles, showcasing the company’s adaptability in navigating the ever-evolving landscape of the automotive industry.