Amazon Hits $2 Trillion in Value as AI Frenzy Fuels Rally

Amazon.com Inc. has reached a $2 trillion market valuation for the first time ever as an artificial intelligence-fueled rally pushed the tech giant deeper into record territory. Shares rose 3.9% on Wednesday to close at $193.61, pushing the market value to more than $2 trillion. The company now joins an elite club of a handful of peers that have surpassed this key market capitalization threshold. Alphabet Inc. passed the $2 trillion mark in late April, while rallies have pushed the market values of Nvidia Corp., Microsoft Corp., and Apple Inc. to over $3 trillion.

Amazon shares have been volatile since the company’s first-quarter earnings, where the cloud unit posted the strongest sales growth in a year, propelling the stock back above its all-time high set in April. The stock surged in June, recovering losses from the end of May, and has gained 27% so far this year.

Shares of the megacap technology company have gotten a lift over the past year as Amazon cut costs and restructured its business to better capitalize on the AI frenzy. Additionally, its key Amazon Web Services (AWS) business has shown signs of re-accelerating growth, a major point of optimism for investors.

“Part of the good stock performance over the last six to nine months for Amazon has been related to the fact that it was oversold at the end of 2022,” said Dan Romanoff, an analyst at Morningstar Investment Service.

The AI-driven rally that has propelled Amazon to this milestone is part of a broader trend affecting major tech companies. Alphabet, Nvidia, Microsoft, and Apple have all benefited from investor enthusiasm around AI technologies, which are seen as key drivers of future growth in the tech sector.

Amazon’s achievement of a $2 trillion market valuation is a testament to its robust performance and strategic positioning in the AI landscape. The company’s ability to innovate and adapt its business model to leverage emerging technologies has been crucial in maintaining its competitive edge.

The cloud unit’s resurgence has been particularly significant, as AWS remains a cornerstone of Amazon’s business and a major contributor to its revenue growth. The recent sales growth in this division underscores the growing demand for cloud computing services, especially those integrated with advanced AI capabilities.

As Amazon continues to expand its AI-driven initiatives, the company is poised to further cement its leadership in the technology sector. The successful integration of AI into its business operations not only enhances its service offerings but also creates new opportunities for growth and market expansion.

For more details, visit the source here.

Investor Beware: Micron’s Selloff Exposes AI Stock Risks

Micron Technology Inc.’s post-results selloff serves as a fresh reminder to global investors about the risks inherent in betting on artificial intelligence chipmakers. The memory chip manufacturer’s shares fell about 8% in extended trading after issuing a forecast that did not meet the highest estimates, underscoring the volatility and high expectations in the AI sector.

Just days after leading AI chipmaker Nvidia Corp. saw a nearly half-trillion-dollar slump, Micron’s stock drop further highlighted the precarious nature of the AI-driven market surge. Despite the company’s high-bandwidth memory being a potential complement to Nvidia’s industry-leading chips for training large language models, Micron was penalized for not exceeding the lofty expectations set by the market. Its shares had more than doubled in the year leading up to the report, but the outlook in line with average analyst estimates was not enough to sustain investor confidence.

“The market is holding totally unrealistic expectations, as many names who are beating street estimates by a wide margin are still being sold down,” said Andrew Jackson, head of Japan equity strategy at Ortus Advisors Pte in Singapore. “But I think the street is very well aware of the fact that these US names are pretty overcooked. Too many paper hands chasing the fast easy money.”

The big jumps in market value appear vulnerable to rapid correction, as evidenced by Nvidia’s shares entering correction territory earlier this week before bouncing back. A global gauge tracking semiconductor shares has fallen about 5% since reaching an all-time high earlier this month. Taiwan Semiconductor Manufacturing Co., which produces Nvidia’s most valuable chips and is considered critical for AI, has slipped more than 2% since its June 19 high.

Micron’s announcement also triggered declines in South Korea’s two biggest companies, memory makers Samsung Electronics Co. and SK Hynix Inc., though they recouped their losses by the close on Thursday. For these businesses, whose traditional output includes supplying memory for PCs, smartphones, and more conventional data center use, last year’s slump adds to the current share price uncertainty.

Micron’s briefing fell short of what SK Hynix had previously offered when it announced that its HBM production capacity is largely sold out through 2025, noted Tom Kang, director at Counterpoint Research. Micron lacks the dominant position in AI memory that SK Hynix enjoys or Samsung’s lead in the broader memory industry, he added.

“This brings a reality check to the AI sector, which looks bubblish,” Kang said.

For more details, visit the source here.

From Cellphone Batteries to EV Giants: The Rise of BYD’s Wang Chuanfu

At the headquarters of BYD Co. in Shenzhen, there’s a wall crammed floor to ceiling with about a thousand framed patents representing more than 30,000 innovations the electric-vehicle maker’s billionaire founder, Wang Chuanfu, and his army of engineers have devised.

A wall displays patent certifications held by BYD in an exhibition area at the company’s headquarters in Shenzhen.

The patents—for breakthroughs such as the low-cost lithium-iron-phosphate battery that’s also used by rivals including Ford, Tesla, and even Toyota—are among the invisible assets turning Wang’s company into the world’s biggest EV maker. After selling 3 million electric and hybrid vehicles in 2023 and logging $85 billion in revenue, it’s on course to overtake Tesla Inc. this year. Now Wang is further disrupting China’s EV industry with cars costing less than $10,000, bringing affordable transport to the masses—once an Elon Musk goal.

The success of Wang’s two-decade bet on EV tech has led many to call him the Elon Musk of China. But unlike the Tesla co-founder, whose ventures range from EVs to space travel to brain implants to tunnel boring, the BYD chief has been far more focused.

The 58-year-old Wang, who studied battery metal chemistry in college, started making cellphone batteries in 1995. He continually refined the technology for bigger car batteries—attracting attention and investment cash from Berkshire Hathaway Inc. Chairman Warren Buffett along the way. As the company grew, Wang steered it into complementary businesses such as battery storage, semiconductors, and solar, but he always worked to keep prices low, in line with BYD’s “Build Your Dreams” motto.

In addition to being an innovator who spotted the prospects of battery-making early on, Wang is known as a management execution specialist. He saw vertical integration as key to BYD’s strategy: The lower costs that came from controlling his supply chain gave him a standout advantage over rivals.

Charlie Munger, the late vice chairman of Berkshire Hathaway, hailed Wang as a fanatical engineer and a genius who saved BYD in its formative years from going broke with his own 70-hour workweeks. Munger said Wang’s willingness to understand concepts and actually make things, practically with his bare hands, made him better than Musk.

Bill Russo of Shanghai-based consultants Automobility says Wang “is to the 21st century EV industry what Henry Ford was to the 20th century automotive industry: Both entrepreneurs leveraged vertical integration and economies of scale to democratize mobility.”

Google Rolls Out Gemini Side Panel Across Gmail, Docs, and More Workspace Apps

Google is enhancing its Workspace suite with the launch of the Gemini side panel, a powerful AI-driven toolset now available to paid subscribers. Announced at Google I/O 2024, this feature aims to transform how users interact with Gmail, Google Drive, Docs, Sheets, and Slides by integrating advanced AI capabilities directly into their workflow.

Gemini: Your AI-Powered Workspace Assistant

The Gemini side panel, initially known as Duet AI, is designed to streamline productivity by offering contextual assistance across various Google Workspace apps. Available to Google One AI Premium members and other paid users, Gemini provides a range of functionalities tailored to enhance user experience in Gmail, Docs, Slides, Sheets, and Drive.

Enhancing Productivity Across Apps

In Google Docs, Gemini assists users in writing, refining content, summarizing information, and generating new content based on existing files. It acts as a brainstorming partner, making it easier to create well-structured documents.

Google Slides users can leverage Gemini to generate new slides, create custom images, and summarize presentations. This feature helps in quickly crafting compelling visual content and ensures presentations are cohesive and engaging.

Google Sheets benefits from Gemini’s ability to track and organize data efficiently. Users can create tables, generate formulas, and receive guidance on accomplishing various tasks, making data management more intuitive and less time-consuming.

In Google Drive, Gemini can summarize documents, provide quick project facts, or offer deep dives on specific topics without requiring users to sift through multiple files. This functionality is particularly useful for managing extensive document repositories and accessing critical information swiftly.

For Gmail, Gemini offers advanced features such as summarizing email threads, suggesting responses, drafting emails, and retrieving specific information from emails or Drive files. This integration simplifies email management and enhances communication efficiency.

Seamless Integration and Access

Accessible via a new “Ask Gemini” sparkle icon next to the profile avatar on the web, the side panel offers suggested queries and automatic content summaries, facilitating a smoother user experience without the need to switch tabs. This integration complements existing AI features like “Help me write,” “visualize,” and “organize,” which have been well-received by users.

General Availability

Previously available through the Workspace Labs and Gemini for Workspace Alpha program, the side panel is now in general availability and will roll out over the coming weeks. This expansion reflects Google’s commitment to integrating AI into everyday workflows, making advanced tools accessible to a broader audience.

For more information on the Gemini side panel and its capabilities, you can read the full article on 9to5Google. This rollout marks a significant step in Google’s effort to enhance productivity and user engagement through AI-powered solutions.

YouTube Introduces App Tracking Transparency Prompt for iOS Users

YouTube will soon ask iOS users to opt into more personalized advertising. This change, expected to roll out imminently, follows Apple’s iOS 14.5 requirement for apps to explicitly request user consent for tracking activities across other apps and websites.

The New Prompt Explained

Upon opening the YouTube app on an iPhone or iPad, users will encounter a prompt: “Allow YouTube to track your activity across other companies’ apps and websites?” Users will have two choices:

- Allow: Opting in will enable YouTube to link app activity with non-Google apps and websites to deliver personalized ads and more accurate ad measurements. This choice is intended to enhance the relevance of the ads shown to the user and is applicable to all YouTube app users on the device.

- Ask App Not to Track: Declining will result in ads that are less personalized, potentially less relevant, and more repetitive, as YouTube won’t use cross-app and cross-website data to tailor advertising.

YouTube Premium subscribers and accounts designated for children will not see this prompt.

Implications for Users and Creators

Choosing to “Allow” tracking is framed by YouTube as a way to receive a “high-quality, helpful ads experience.” According to a YouTube spokesperson, this could mean advertisements that better reflect user interests, thanks to improved ad measurement techniques. YouTube emphasizes that allowing tracking could ultimately benefit content creators by providing better metrics to advertisers, potentially leading to more lucrative ad campaigns on the platform.

For users opting out, YouTube will rely solely on first-party Google data, resulting in a more generic ad experience. The ATT prompt does not affect YouTube’s ability to show personalized ads using data from other Google apps and websites, assuming the user has consented to personalized ads within their Google account settings.

How to Manage Your Preferences

iOS users can manage their tracking preferences by navigating to Settings > Privacy & Security > Tracking on their device. This setting is specific to YouTube’s integration with third-party apps and websites and does not impact Google’s own apps and services.

Impact on YouTube’s Ad Strategy

This move comes as YouTube adjusts its advertising strategy to comply with evolving privacy regulations while still aiming to deliver effective ad solutions. By incorporating Apple’s ATT framework, YouTube aims to balance user privacy with the needs of advertisers and content creators on its platform.

For further details, refer to the original report by 9to5Google here.

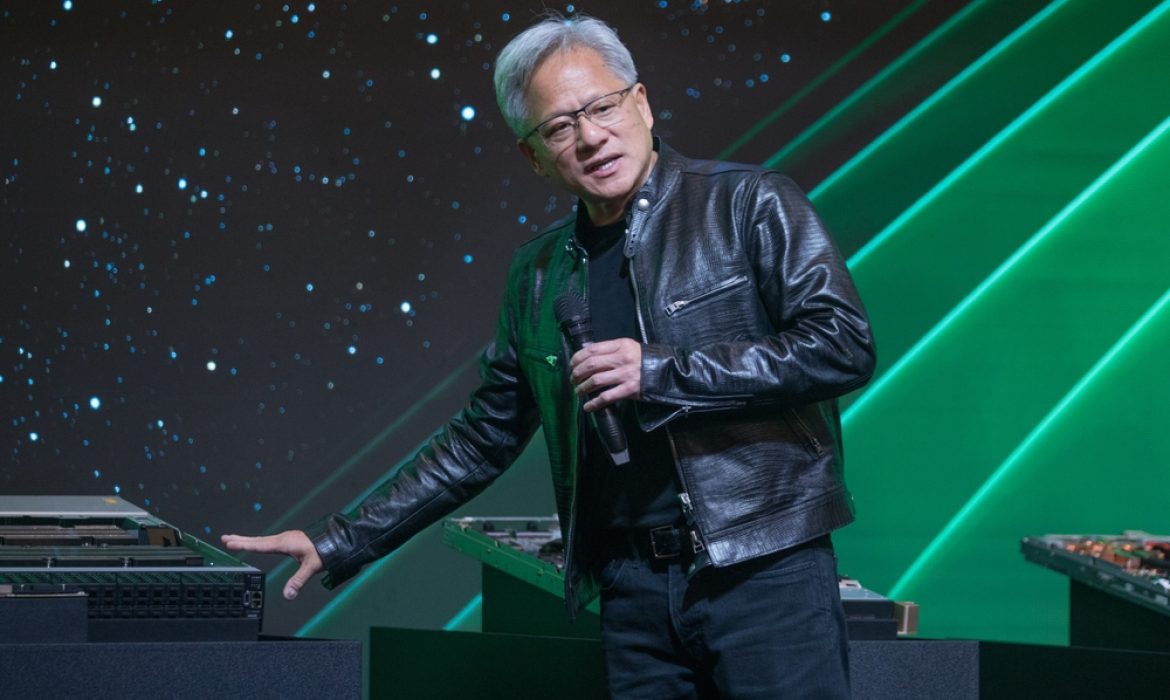

Nvidia’s Market Surge Unstoppable: Shares Soar 165% in 2024, Eyes on Global Top Spot

Nvidia Corporation continues its monumental rise in the stock market, with shares surging over 200% in the past year alone. Analysts are now projecting that the semiconductor giant could achieve a staggering $5 trillion market valuation within the next year, driven by its dominant position in high-demand technologies.

Hans Mosesmann, a prominent analyst at Rosenblatt Securities, has raised his price target for Nvidia to a Wall Street record of $200 per share, up from $140. This bullish move comes on the heels of Nvidia’s recent 10-for-1 stock split in early June, which aimed to increase accessibility and liquidity for investors. The stock responded positively to Mosesmann’s upgrade, climbing as much as 2.7% and reaching new intraday highs.

Based in Santa Clara, California, Nvidia has solidified its market leadership with products crucial for powering data centers that handle complex artificial intelligence computations. The company’s innovations in GPU technology and AI-driven solutions have positioned it at the forefront of the semiconductor industry, attracting significant investor interest and driving its market cap to unprecedented levels.

Mosesmann, who has maintained a buy rating on Nvidia since initiating coverage in 2017, emphasized the critical role of software complementing Nvidia’s hardware offerings. In a note to clients, he highlighted the potential for substantial growth in software sales over the next decade, which could further elevate Nvidia’s valuation due to sustained demand and technological advancement.

Nvidia’s stock is highly favored among sell-side analysts, boasting 64 buy ratings, seven holds, and only one sell rating according to Bloomberg data. This widespread optimism reflects confidence in Nvidia’s strategic direction and its ability to capitalize on evolving market opportunities in AI, gaming, and data center solutions.

In 2024 alone, Nvidia’s shares have surged by 165%, contributing over $2 trillion to its market capitalization. The company’s rapid ascent has positioned it on the brink of surpassing tech giants like Microsoft and Apple in market value, underscoring its pivotal role in shaping the future of semiconductor technology.

As Nvidia continues to innovate with upcoming launches such as the Blackwell data center architecture and the RTX 50xx series of graphics cards, market observers anticipate further growth momentum. Analysts foresee Nvidia’s trajectory potentially reaching a historic $5 trillion valuation, driven by ongoing technological advancements and expanding market opportunities.

For a detailed analysis of Nvidia’s market outlook and recent performance, read the full story on Fortune.

New Era for Smart Rings: Samsung’s Galaxy Ring Set for August Launch

Samsung isn’t waiting around for Oura to file any patent claims over its forthcoming smart ring. Instead, it’s preemptively filed its own suit against Oura, seeking a “declaratory judgment” that states the Galaxy Ring doesn’t infringe on five Oura patents.

The suit alleges that Oura has a pattern of filing patent suits against competitors based on “features common to virtually all smart rings.” In particular, the suit references sensors, electronics, batteries, and scores based on metrics gathered from sensors. The case lists instances in which Oura sued rivals like Ultrahuman, Circular, and RingConn, sometimes before they even entered the US market.

Samsung’s move is not just about legal protection. The lawsuit also confirms several details about the forthcoming Galaxy Ring. It notes that the hardware design was finalized in mid-May, that it’s scheduled to begin mass production in mid-June, and is expected to hit the US market “in or around August of this year.” It also includes a Samsung Health app screenshot showing an “Energy Score” feature based on metrics like sleep, activity, heart rate, and heart rate variability.

It’s not uncommon to see these types of patent battles in the gadget world. Medical device maker Masimo, for example, made headlines late last year when it won an ITC import ban against the Apple Watch, claiming it infringed on its blood oxygen patents. That said, if the court rules in Samsung’s favor, it could have a ripple effect in the smart ring market. Until now, Oura has been virtually uncontested as the leader of the smart ring market. Samsung is the first big-name tech giant to throw its hat in the ring — and given its rich gadget ecosystem, it poses a real threat to Oura in a way smaller, less recognizable smart ring makers haven’t. Plus, a win for Samsung here could give smaller smart ring makers some ammo against Oura.

In any case, Samsung’s entrance into the smart ring market is a sign this category is heating up after a few years of sitting on the back burner. And if the past few months are any indication, Oura may be feeling the heat. It’s released several software updates in the past few months, while also expanding its sales channels to retailers like Best Buy, Target, and Amazon.

Apple Reclaims Top Spot as World’s Most Valuable Company, Riding AI Wave

Apple Inc. has surpassed Microsoft Corp. to become the world’s most valuable company, a testament to its aggressive push into artificial intelligence (AI). This transition marks the first time in five months that Apple has overtaken its rival in market valuation.

On June 12, Apple’s stock (AAPL.O) surged nearly 4% to an all-time high of $215.04, catapulting its market capitalization to $3.29 trillion. In contrast, Microsoft’s (MSFT.O) market cap settled at $3.24 trillion, reflecting a pivotal moment in the high-stakes race among tech giants to dominate AI technology.

The rally in Apple’s shares follows a broader upswing in the tech-heavy Nasdaq index, spurred by encouraging signs of easing inflation. This bullish sentiment was further bolstered by Apple’s unveiling of groundbreaking AI features during its annual Worldwide Developers Conference (WWDC). The new capabilities, which include enhanced functionalities for Siri and AI-driven software improvements across its device ecosystem, have prompted a surge in investor confidence and anticipated robust iPhone sales.

“The AI advancements announced at WWDC addressed long-standing concerns about Apple’s position in AI technology,” stated Michael James, Managing Director of Equity Trading at Wedbush Securities. “These innovations signal a strong demand for a major iPhone upgrade cycle.”

Apple’s strategic focus on AI represents a shift in the company’s approach. Historically, it lagged behind competitors like Microsoft and Google-parent Alphabet in AI adoption, which impacted its stock performance earlier this year. However, recent successes, including beating market expectations for quarterly results in May and announcing a record $110 billion stock buyback, have rekindled investor enthusiasm. Apple’s shares have seen a 12% increase in 2024, despite being outpaced by Microsoft’s 16% and Alphabet’s 28% gains.

The resurgence of Apple’s stock also highlights a broader trend in the tech sector. Nvidia (NVDA.O), a leading player in AI chips, briefly surpassed Apple’s market value last week and has seen a staggering 154% rise this year. Meanwhile, Tesla (TSLA.O) remains the only other major tech stock to underperform Apple, with a 30% decline.

As Apple continues to embed AI deeper into its product lineup, it reinforces its commitment to staying at the forefront of technological innovation. This development underscores the evolving dynamics in the tech industry, where AI is becoming an increasingly pivotal factor in determining market leadership.

For more details, visit the full article on Reuters.

BYD Founder Slams Western Fears Over Chinese Electric Vehicle Invasion

Wang Chuanfu, Chairman of BYD Co., China’s largest auto company, declared that Western countries are apprehensive about Chinese electric vehicles (EVs). Wang attributed this wariness to the growing strength of China’s automotive industry.

“The reaction by politicians in other countries shows they are afraid of Chinese EVs,” Wang stated, highlighting the competitive edge China has achieved in the global EV market. “If you are not strong enough, they will not be afraid of you,” he added, underscoring China’s rising influence in the automotive sector.

The European Union is expected to announce tariffs targeting Chinese EVs soon, following an investigation into Beijing’s subsidies for EVs. This move is likely to impact the flow of Chinese imports into Europe, where brands like MG Motors and BYD accounted for nearly 9% of battery-electric vehicle sales last year, with projections to reach 20% by 2027.

BYD has significantly ramped up its EV production, ceasing combustion engine vehicle production in 2022 and achieving sales of 3 million electric and hybrid vehicles by 2023. This milestone propelled BYD into the top 10 global automakers by sales volume.

During his speech, Wang urged the industry to embrace competition amid the shift towards electric mobility. BYD has initiated a price war in China by reducing the costs of its EVs and plug-in hybrids, targeting established automakers like Toyota and Volkswagen with its cost-effective electric alternatives.

Wang emphasized the inevitability of electric and hybrid vehicles overtaking traditional engines, calling it an unstoppable trend. His remarks reflect BYD’s aggressive stance in the global EV market and its commitment to driving the transition to electric mobility.

For further insights into the evolving dynamics of the global EV market and BYD’s strategic moves, read more on Bloomberg.

Instagram Tests Unskippable Ads, Drawing Mixed Reactions

Instagram is experimenting with unskippable ads. The social media giant confirmed the test after users began circulating screenshots of the feature online.

The new ad format introduces a countdown timer, effectively pausing users’ ability to scroll past content until they view the ad. This approach mirrors the advertising model used by YouTube, where unskippable ads are a common experience for viewers who use the free version of the service. As Instagram continues to evolve from a photo-sharing app to a video-centric platform with features like Stories and Reels, it’s exploring similar ad revenue strategies.

“We’re always testing formats that can drive value for advertisers,” a Meta spokesperson told TechCrunch. “As we test and learn, we will provide updates should this test result in any formal product changes,” they added. This statement reflects Meta’s broader strategy of experimenting with various monetization techniques across its platforms to enhance advertiser engagement while balancing user experience.

The feature was first spotted by Instagram user Dan Levy, who shared his experience on X (formerly Twitter). Levy described the ad interruption as a “bonkers move” after being unable to bypass the ad.

Screenshots shared by Levy show a notification reading, “You’re seeing an ad break. Ad breaks are a new way of seeing ads on Instagram. Sometimes you may need to view an ad before you keep browsing.”

The reaction to this test has been predominantly negative, with many users expressing their displeasure across social media platforms.

Some threatened to abandon Instagram altogether if the unskippable ads become a permanent feature, while others criticized Meta for potentially prioritizing ad revenue over user satisfaction. A discussion thread on Reddit corroborated these sentiments, with users confirming their experiences and voicing concerns over the impact on their browsing habits.

Despite the uproar, Instagram has yet to disclose specifics about the test’s scope, such as its geographical rollout or the exact placement of the ads within the app. The initial screenshots suggest that the ads might appear in the Feed during video posts, although this remains unconfirmed. Additionally, it’s unclear if creators on Instagram will have any control over when and where these ads appear.

For now, this unskippable ad feature remains in the testing phase, but it highlights Meta’s willingness to push the boundaries of user experience in pursuit of advertising dollars. The outcome of this test could significantly influence how Instagram balances user engagement with advertiser demands in the future.