Geely Unveils Game-Changing Electric SUV: Galaxy E5 Promises 2000 km Range

The automotive world was electrified as Geely Galaxy pulled back the curtain on its groundbreaking all-electric SUV, the E5. Breaking new ground as the inaugural electric addition to the esteemed Galaxy series, the E5 promises to revolutionize the electric vehicle (EV) market with its impressive specs and futuristic design. The highly anticipated vehicle is slated to hit the market in the second quarter, with an estimated price range of RMB 150,000-200,000 (USD 20,800-27,700).

Intelligent Design and Innovation

The Geely Galaxy E5 is built upon the Geely Electric Architecture (GEA), a marvel derived from the Sustainable Energy Architecture (SEA). GEA boasts the distinction of being the world’s first four-in-one intelligent AI architecture, comprising hardware, system, ecology, and artificial intelligence. With dimensions measuring 4615/1901/1670 mm and a wheelbase of 2750 mm, the E5 exudes an aura of sophistication, complete with a panoramic sunroof, concealed door handles, and sleek 18/19-inch five-spoke wheels.

Futuristic Features

Drawing inspiration from its predecessor, the Geely Galaxy E8, the E5 sports a striking design language characterized by a closed matrix light grille, sharp headlights, and decorative C-shaped vents at the bottom. Meanwhile, the rear boasts an integrated, high-mounted brake light and the iconic through-type taillight package, featuring a captivating wave-shaped light element at its core.

Power and Performance

While official powertrain details remain shrouded in mystery, Geely has tantalized enthusiasts with hints of an 11-in-1 smart electric drive and a Shendun battery. Most notably, the E5 boasts an unprecedented potential range of 2000 km, setting a new benchmark for long-distance travel in the realm of electric vehicles. Geely previously showcased a single-motor variant at China MIIT, boasting a maximum power output of 160 kW and utilizing a lithium iron phosphate battery with a top speed of 175 km/h.

Tech-Savvy Interior

Step inside the E5, and you’ll find yourself immersed in a minimalist marvel. The cabin showcases a dual flat-bottom steering wheel, a head-up display, and a full LCD instrument panel. Anchoring the dashboard is a sizable central control screen, seamlessly integrating the Flyme Auto operating system powered by the cutting-edge 7nm Dragon Eagle-1 chip. Additional features include OTA updates, wireless mobile phone charging, heated/ventilated/8-point massage front seats, and a premium 16-speaker audio system.

The unveiling of the Geely Galaxy E5 marks a significant milestone in the evolution of electric vehicles, heralding a new era of innovation, efficiency, and sustainability. With its unparalleled range and futuristic features, the E5 is poised to redefine the automotive landscape and propel Geely Galaxy to the forefront of the EV revolution.

Apple Unveils New iPad Pros with OLED Displays and Ultra-Thin Design

In a highly anticipated “Let Loose” virtual event on May 7, 2024, Apple announced its latest iPad Pro models, featuring OLED displays, the thinnest designs yet, and enhanced internals. This upgrade comes as a significant leap for Apple’s flagship tablets, offering improved power and versatility in a sleek form factor.

The new iPad Pros mark Apple’s transition to OLED screens, with the 11-inch and 13-inch models benefiting from the rich color saturation, deeper blacks, and higher contrast ratios that OLED technology provides. This change addresses a long-standing request from users and brings greater visual performance, particularly for fans of the smaller 11-inch model. The OLED display allows the iPad Pros to reach 1,000 nits of peak full-screen brightness and up to 1,600 nits for HDR content, making them ideal for media consumption and professional work.

The 13-inch iPad Pro is Apple’s thinnest device ever, measuring just 5.1 millimeters thick, while the 11-inch variant is slightly thicker at 5.3 millimeters. Apple also introduced a nano-texture glass coating for those who prefer a matte display finish, offering reduced glare and enhanced visibility in bright environments.

The new iPad Pros are powered by Apple’s latest M4 chip, providing a significant boost in CPU performance compared to the previous generation’s M2 chip. Apple claims a 50% increase in CPU speed, with the M4 delivering the same performance as the M2 at half the power consumption, thanks to improved efficiency. The thermal performance has also seen a 20% enhancement, allowing the iPad Pro to handle intense workloads with greater stability.

The Magic Keyboard has been redesigned with premium materials, featuring an aluminum palm rest and a new function key row. The Apple Pencil Pro has also received an upgrade, with added features such as squeeze gestures, Find My location tracking, and a gyroscope for more nuanced drawing controls. Haptic feedback has also been introduced to enhance the user experience when using the Apple Pencil Pro.

The new iPad Pros come in two sizes, with base storage of 256GB, priced at $999 for the 11-inch model and $1,299 for the 13-inch variant. They are available for preorder starting today, with in-store availability on May 15th.

Apple’s shift to OLED technology is a major step forward, eliminating the blooming effect often seen with Mini LED displays and providing consistent high-quality visuals across both iPad Pro sizes. This update reinforces Apple’s vision of the iPad Pro as a viable laptop replacement, offering premium performance in a compact and thin design.

For more information about the new iPad Pros and their features, check out The Verge.

YouTube Premium Unveils ‘Jump Ahead’ Feature

YouTube Premium subscribers are gaining access to an innovative new feature that uses artificial intelligence to help viewers skip to the most engaging parts of a video. The “Jump Ahead” feature, first introduced as an experimental project in March, is now more widely available through youtube.com/new. This enhancement offers a new way to navigate videos, making it easier for Premium members to bypass less interesting content.

“Jump Ahead” works by analyzing user behavior and identifying common points where viewers tend to skip. After double-tapping to skip ahead, a “Jump Ahead” button appears in the bottom-right corner, suggesting a popular point of interest in the video. Tapping this button will immediately take users to that section, allowing them to quickly access the most engaging content. This AI-powered feature aims to improve the overall viewing experience, reducing unnecessary waiting and increasing viewer satisfaction.

YouTube initially launched “Jump Ahead” as a small-scale test, but the feature is now available to a broader group of Premium subscribers. To access this new functionality, users must have the YouTube Android app and be located in the United States. The feature is also limited to English-language videos and may not be available on every video. High view counts appear to be a common factor in determining which videos are eligible.

The experimental feature is part of YouTube’s ongoing efforts to improve user experience for Premium subscribers. As YouTube continues to explore new ways to use AI and machine learning, features like “Jump Ahead” demonstrate the platform’s commitment to innovation and user satisfaction. Premium members are encouraged to try the new feature and provide feedback through the youtube.com/new page, where they can also discover other experimental features in development.

With a June 1 end date listed for this experiment, YouTube may extend the testing period based on user feedback and engagement. As the feature is refined, Premium subscribers can expect further enhancements that will streamline their YouTube viewing experience.

For more information on this development, visit the source article from 9to5Google.

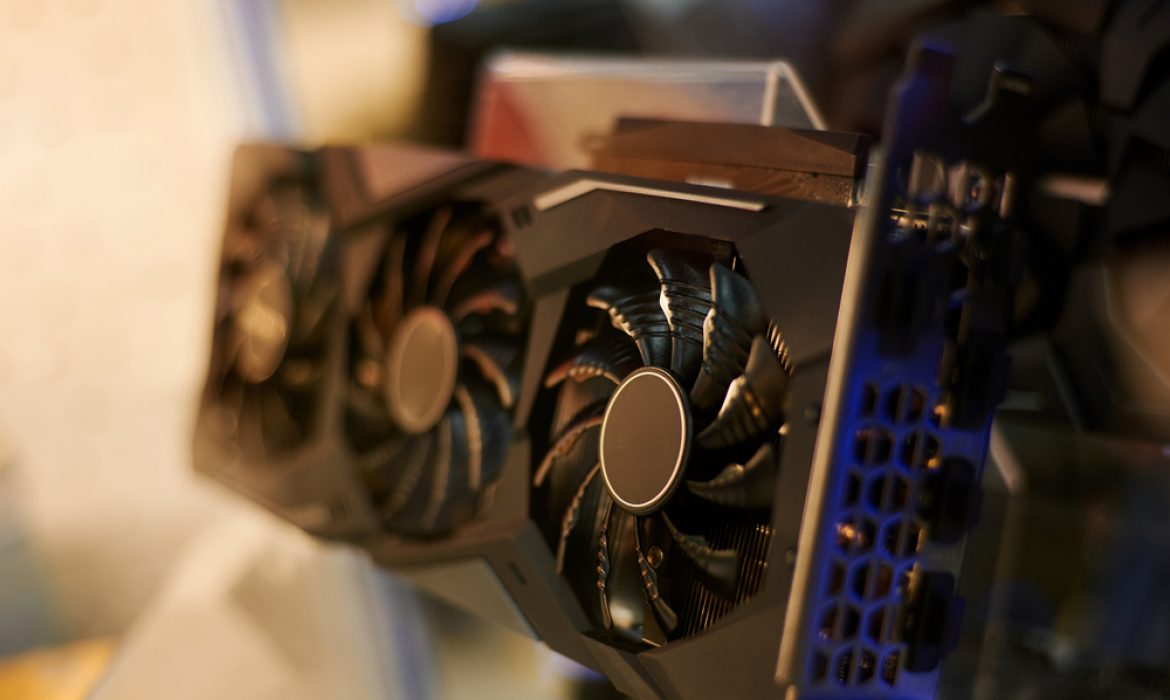

AMD’s Gaming Revenue Plummets 48%, May Not Bounce Back Until 2025

AMD’s gaming segment is taking a massive hit, with revenue plunging by a staggering 48% year-over-year in the first quarter of 2024. This decline is attributed to decreased sales of processors for gaming consoles and a lack of demand for Radeon discrete graphics cards. The company expects these numbers to dip even further throughout the year, with recovery not anticipated until 2025. This slump could impact the expected launch of AMD’s next-generation Radeon RX 8000-series RDNA 4 GPUs, which may not hit the market this year.

A Sharp Drop in Revenue

AMD’s gaming revenue for Q1 2024 stood at $922 million, a significant drop from $1.757 billion in the same period the previous year. The decline continued on a quarterly basis, falling 33% from Q4 2023’s revenue of $1.368 billion. While AMD’s gaming segment still posted an operating income of $151 million, that’s a stark contrast to the $314 million achieved a year earlier. The reduced sales figures raise questions about the future of AMD’s gaming products, particularly with the possibility of RDNA 4 GPUs being delayed or scrapped altogether.

Console Sales on the Decline

The dip in AMD’s gaming revenue can be largely attributed to lower demand for system-on-chips (SoCs) used in Sony’s PlayStation 5 and Microsoft’s Xbox Series X|S consoles. These platforms are in their fifth year, leading to a natural decrease in consumer demand. This decline impacts AMD’s sales, as console SoCs are a significant part of its gaming business. AMD’s Chief Financial Officer, Jean Hu, confirmed that semi-custom SoC sales decreased as expected, given the console cycle.

GPU Sales Facing Challenges

In the discrete GPU market, AMD has struggled to gain significant traction with its Radeon RX 7000-series. Seasonal fluctuations and a lack of design wins with Radeon RX 7000M GPUs for laptops have contributed to the lower sales. AMD’s CFO Jean Hu has indicated that the second half of 2024 could be even worse for the gaming segment, with a “significant double-digit percentage” decline expected. This downturn raises doubts about AMD’s commitment to launching new high-end GPUs, potentially leaving Nvidia with an even greater market share in the lucrative high-end graphics card sector.

The uncertainty surrounding AMD’s gaming revenue could shape the company’s strategy for the coming years, with a greater focus on cost-effective products rather than high-end GPUs. Whether or not AMD’s gaming segment can recover in 2025 remains to be seen.

Spotify Sees a Surge in Subscribers and Profits with a 14% Increase in Paid Channels

Spotify Technology SA shares experienced a significant boost, marking the largest one-day jump in nearly two years, following the announcement of a first-quarter profit. This surge is fueled by a considerable increase in the number of paid subscribers, which grew by 14% year-on-year to 239 million, matching analysts’ expectations.

Spotify’s total number of active users, including those on ad-supported plans, rose to 615 million, slightly below analysts’ forecast of 617.9 million. Despite this minor gap, the Swedish company demonstrated resilience and adaptability in a competitive market.

The company’s shares surged by 16%, reaching $314.80 in New York, the biggest intraday gain since July 2022. This upward trend is a reflection of Spotify’s continued success in diversifying its business model beyond music streaming, venturing into other audio entertainment categories, including audiobooks.

Spotify’s Strategic Shift in Business Model and Pricing

To maintain its growth trajectory, Spotify is evolving its business model. The company, known for its strict adherence to free-with-ads and paid-without-ads models, is experimenting with new pricing plans, including tiers without audiobooks for a lower monthly fee and music-only options. This shift comes after Spotify’s first price increase in more than a decade and plans for another hike by the end of the month.

Total revenue for the quarter rose 20% to 3.6 billion euros ($3.8 billion), with a net income of 197 million euros. The adjusted operating profit reached 168 million euros, a record high for the company.

Spotify’s push into audiobooks has gained traction, with 25% of users who have access to the offering clicking play at least once. Despite cuts in staff and podcast programs, Spotify continues to strengthen its position in the audio entertainment sector, renewing deals with key figures like comedian Joe Rogan and expanding distribution to platforms like YouTube and Apple Podcasts.

Outlook for the Second Quarter

Spotify expects to reach 631 million active users in the second quarter, with 245 million premium subscribers. While these figures are slightly below analysts’ forecasts, the company remains optimistic. Management anticipates sales of 3.8 billion euros, slightly above the average forecast of 3.76 billion euros, and an operating profit of 250 million euros, exceeding analysts’ predictions of 175.3 million euros.

For more details on Spotify’s first-quarter results and its future projections, visit Bloomberg.

Google Officially Joins the $2 Trillion Club: A Milestone in Tech History

Google, one of the world’s tech giants, has officially become a $2 trillion company, marking a significant milestone in its 25-year history. This achievement comes after a challenging year in which the company faced two major threats: the rapid rise of generative AI and increasing regulatory scrutiny. The impact of AI has been profound, leading to significant changes in Google’s search strategy, restructuring of its Search, Android, and hardware teams, and the launch of its own Gemini AI model.

To adapt to these changes, Google executives cut projects and laid off employees, and yesterday the company announced its first-ever dividend along with a $70 billion share buyback program alongside its Q1 2024 earnings report. The financial results were strong, with Google’s parent company Alphabet officially maintaining a $2 trillion market capitalization for an entire day of trading, a level it briefly touched in November 2021. This makes Google the fourth most valuable public company globally, trailing Nvidia ($2.2 trillion), Apple ($2.6 trillion), and Microsoft ($3.0 trillion).

Investors React Positively to Google’s Q1 2024 Earnings

Investors have welcomed the news, pushing Google’s stock upward after the Q1 2024 earnings report showed substantial growth. The company recorded $80.5 billion in revenue, a 15% increase year over year, and $23.7 billion in profit, a 14% increase over the previous quarter. The rise in revenue was largely driven by search and advertising, which each saw a 14% increase year over year. Additionally, YouTube ads grew by nearly 21%, and “subscriptions, platforms, and devices” saw an 18% rise due to premium YouTube subscriptions, as noted by Google chief business officer Philipp Schindler.

Google’s Strategies in Response to the Changing Tech Landscape

Google is finding innovative ways to monetize AI. For instance, the company is helping advertisers target people using its AI-driven Performance Max tool, with a reported 63% of advertisers having successful campaigns. Additionally, Google reported that Discover Financial is deploying AI tools to nearly 10,000 call center agents, and Ikea is seeing an increase in revenue from “value-based bidding solutions.”

Despite these strides in AI, Google remains cautious about disrupting search too much. CEO Sundar Pichai emphasized a measured approach, focusing on enhancing the search experience while prioritizing traffic to websites and merchants.

Google’s upcoming Google I/O developer conference on May 14th is expected to reveal more about the company’s plans and innovations in the tech sector.

For more information on this story, visit The Verge.

Tesla Profits Plunge 55% Amid Slower EV Sales and Rising Competition

Electric vehicle (EV) manufacturer Tesla has reported a dramatic 55% drop in profits in the first quarter of 2024, revealing that the EV market is under pressure from hybrid vehicles and other challenges. The company’s revenue also decreased, falling to $21.3 billion, a 9% drop from the previous year, raising concerns about the automaker’s future strategy.

Despite the challenges, Tesla CEO Elon Musk remained upbeat about the company’s direction, focusing on new products and technology. Tesla’s operating income decreased by 54%, largely due to unforeseen events, such as the Red Sea conflict and an arson attack at its Gigafactory Berlin. The company also mentioned that the slower ramp-up of the updated Model 3 at the Fremont factory contributed to the downward trend.

The EV market has faced increased competition from hybrids, with many automakers rethinking their approach to electric vehicles. Tesla’s CEO acknowledged this pressure, but he maintained that the company would continue to focus on pure electric vehicles, as he believes they will ultimately dominate the market. This strategic vision appeared to resonate with investors, as Tesla’s shares surged by 12% after the earnings release.

Tesla’s focus on future innovation was highlighted in its Q1 report, indicating that the company has been investing heavily in research and development, spending $1.1 billion in the first quarter, a 49% increase from the same period last year. Musk emphasized that the company is working on a new vehicle lineup and hinted at new models using a next-generation platform, with production expected in 2025.

However, Tesla’s strategy of price cuts to stimulate EV sales has taken a toll on its profits. The company delivered 386,810 vehicles in the first quarter, down 20% from the previous quarter and 8.5% from the same period in 2023. Automotive gross margins, excluding regulatory credits, also dropped, raising questions about the long-term sustainability of Tesla’s pricing strategy.

Tesla’s other projects, such as the Tesla Semi, have also experienced delays. Initially planned for 2019, the Semi’s mass production has been postponed to 2025, with external customer deliveries expected in 2026. Despite these setbacks, the company continues to make strides in other areas, like energy storage, where it recorded a record 4.1 GWh deployment in the first quarter, driving energy generation and storage revenue up by 7%.

For more details on Tesla’s Q1 earnings report and its strategic roadmap, visit TechCrunch.

Apple’s Losses in China: Huawei’s Gain

Apple’s iPhone sales have dropped by 19% in the first quarter of 2024, while Huawei saw a staggering 69.7% increase in sales during the same period, according to a report from Counterpoint Research. This trend highlights a significant reshaping of the competitive landscape in China, with Huawei’s resurgence reshuffling the market dynamics.

Huawei’s remarkable growth is driven by the successful launch of its 5G-enabled Mate 60 series, which has gained traction among consumers, especially in the premium segment priced above $600. The brand’s robust reputation, combined with its strategic marketing initiatives, has helped it reclaim a substantial market share. Despite Huawei’s impressive comeback, HONOR managed to post a healthy 11.5% year-on-year growth, thanks to popular models like the X50 and Play 40, which have bolstered its presence in offline channels.

Apple’s Sluggish Sales and Potential Rebound

Despite Apple’s decline, Senior Analyst Ivan Lam believes that the company’s fortunes could change. “We are seeing slow but steady improvement from week to week,” Lam remarked, noting that the release of new color options and aggressive sales strategies could help Apple rebound. The company’s upcoming Worldwide Developers Conference (WWDC) in June, where it is expected to unveil new artificial intelligence features, could play a critical role in reigniting consumer interest.

Counterpoint’s report points out that overall smartphone sales in China have increased by 1.5% year-on-year, indicating a possible recovery in the broader market. Vivo emerged as the top performer with a 17.4% market share, followed by HONOR at 16.1% and Apple at 15.7%.

Artificial Intelligence’s Role in Market Recovery

Counterpoint expects that integrating artificial intelligence features into smartphones could drive renewed interest in the market. Several Chinese brands, including Xiaomi and Oppo, have already integrated Qualcomm’s Snapdragon 8 Gen 3 processor, designed for AI applications, into their flagship devices. Honor’s latest Magic 6 Pro, featuring eye-controlled driving, is another example of innovative AI-driven functionality that could fuel consumer demand.

For more details, refer to Counterpoint’s full report on their website: Counterpoint Research.

Samsung Enters Emergency Mode with 6-Day Work Week for Executives

Samsung Group, one of South Korea’s largest conglomerates, has implemented a six-day work week for its executives amid growing business uncertainties. The decision follows a series of challenging market conditions, including a sharp depreciation of the Korean won, increasing oil prices, and high borrowing costs. This comes in response to the company’s major businesses posting lower-than-expected results in 2023.

Executives at Samsung Electronics Co., including heads of production and sales units, will now be required to work on either Saturday or Sunday, in addition to the regular five-day work week. The change aims to drive a strategic review of business operations and adapt to the evolving economic landscape.

An executive from Samsung Group remarked, “Considering the performance shortfalls in 2023, we are instituting a six-day work week for executives to instill a sense of urgency and to ensure we are prepared to navigate the current and future challenges.”

Executives across the Samsung Group, including Samsung Display Co., Samsung Electro-Mechanics Co., and Samsung SDS Co., will soon follow suit, with the change taking effect as early as this week. However, employees below the management level will continue to operate under the five-day work week, a policy that Samsung implemented back in 2003.

The move is not unprecedented in South Korea. Earlier this year, SK Group, a major energy and telecommunications conglomerate, reintroduced Saturday meetings for its executives, replacing a once-a-month weekday strategy committee meeting.

Samsung Electronics experienced a significant operating loss of 15 trillion won ($11 billion) in its semiconductor business in 2023, though the company recently reported an increase in operating profit in the first quarter of 2024. However, ongoing geopolitical tensions and market volatility may pose further risks to the company’s recovery.

For more information on Samsung’s business strategy and the impact of the 6-day work week, visit KED Global.

Goodbye App Store: Apple Finally Allows App Downloads from Third-Party Sites in the EU

Apple’s stronghold over iOS apps is undergoing a seismic shift in the European Union as the tech giant announces a groundbreaking change: the allowance of app downloads from third-party websites. This move, unveiled in compliance with the new Digital Markets Act (DMA), marks a significant departure from Apple’s traditional walled-garden approach, where all app distribution was funneled through its App Store.

According to a report by TechCrunch, Apple’s new directive permits developers meeting specific criteria to offer their iPhone applications for direct download from their own sites to EU users. However, this newfound freedom comes with strings attached. Developers must adhere to Apple’s terms and conditions, including a novel “core technology fee” of €0.50 for each first annual installation surpassing 1 million downloads, irrespective of distribution channel.

Moreover, developers opting for direct web distribution must maintain a stellar reputation, commit to handling intellectual property disputes and governmental takedown requests, and provide customer service—services Apple will not offer for externally downloaded apps. All distributed apps must also undergo notarization to ensure platform integrity.

For end-users, the process of downloading apps from third-party sources introduces additional layers of authorization, aiming to mitigate potential security risks. Initial downloads prompt users to authorize installations directly from developers, accompanied by subsequent warnings about the management of updates and purchases outside the App Store ecosystem.

While Apple justifies these measures as essential for user security, critics view them as “scare screens,” potentially dissuading users from exploring alternatives outside the App Store. The European Commission has expressed interest in scrutinizing Apple’s compliance with the DMA, particularly regarding app distribution and fee structures.

The introduction of web distribution for iOS apps offers developers an alternative avenue to reach users, alongside traditional App Store distribution and the option to host alternative stores on Apple’s platform. However, the extent of developer uptake remains uncertain, with Apple acknowledging that it’s a nascent capability whose adoption trajectory is yet to unfold.

As Apple navigates the evolving regulatory landscape in the EU, the implications of its newfound openness to third-party app distribution will continue to reverberate across the mobile ecosystem, reshaping the dynamics between developers, platforms, and users.