Nvidia Corporation continues its monumental rise in the stock market, with shares surging over 200% in the past year alone. Analysts are now projecting that the semiconductor giant could achieve a staggering $5 trillion market valuation within the next year, driven by its dominant position in high-demand technologies.

Hans Mosesmann, a prominent analyst at Rosenblatt Securities, has raised his price target for Nvidia to a Wall Street record of $200 per share, up from $140. This bullish move comes on the heels of Nvidia’s recent 10-for-1 stock split in early June, which aimed to increase accessibility and liquidity for investors. The stock responded positively to Mosesmann’s upgrade, climbing as much as 2.7% and reaching new intraday highs.

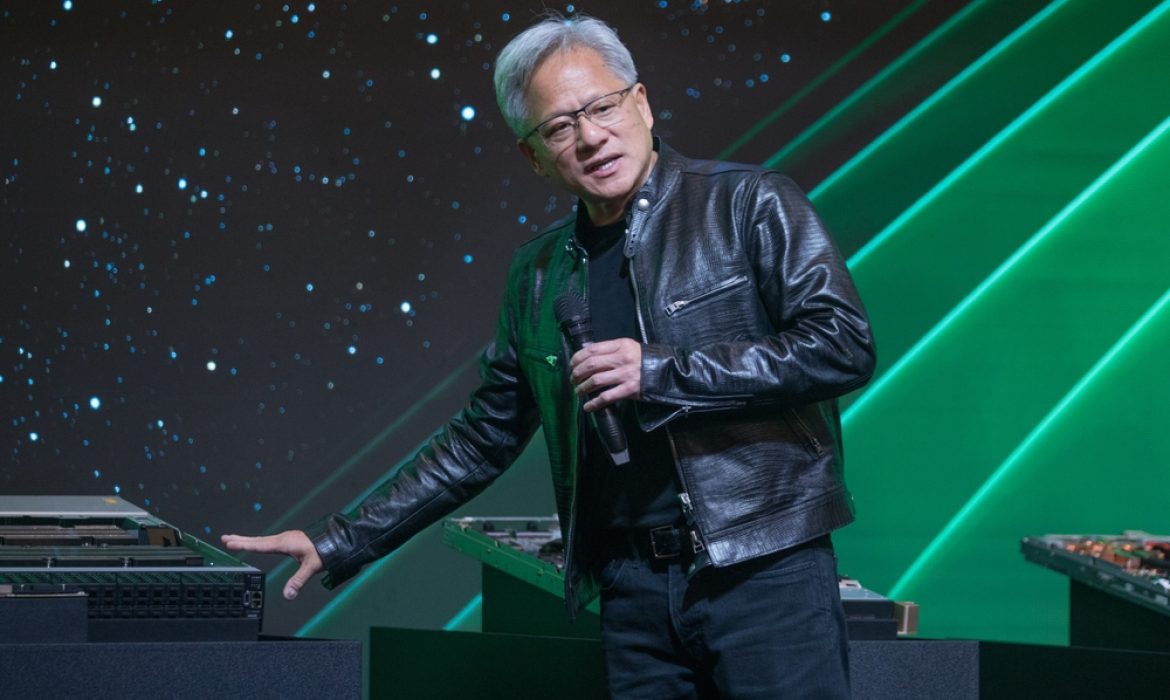

Based in Santa Clara, California, Nvidia has solidified its market leadership with products crucial for powering data centers that handle complex artificial intelligence computations. The company’s innovations in GPU technology and AI-driven solutions have positioned it at the forefront of the semiconductor industry, attracting significant investor interest and driving its market cap to unprecedented levels.

Mosesmann, who has maintained a buy rating on Nvidia since initiating coverage in 2017, emphasized the critical role of software complementing Nvidia’s hardware offerings. In a note to clients, he highlighted the potential for substantial growth in software sales over the next decade, which could further elevate Nvidia’s valuation due to sustained demand and technological advancement.

Nvidia’s stock is highly favored among sell-side analysts, boasting 64 buy ratings, seven holds, and only one sell rating according to Bloomberg data. This widespread optimism reflects confidence in Nvidia’s strategic direction and its ability to capitalize on evolving market opportunities in AI, gaming, and data center solutions.

In 2024 alone, Nvidia’s shares have surged by 165%, contributing over $2 trillion to its market capitalization. The company’s rapid ascent has positioned it on the brink of surpassing tech giants like Microsoft and Apple in market value, underscoring its pivotal role in shaping the future of semiconductor technology.

As Nvidia continues to innovate with upcoming launches such as the Blackwell data center architecture and the RTX 50xx series of graphics cards, market observers anticipate further growth momentum. Analysts foresee Nvidia’s trajectory potentially reaching a historic $5 trillion valuation, driven by ongoing technological advancements and expanding market opportunities.

For a detailed analysis of Nvidia’s market outlook and recent performance, read the full story on Fortune.